In response to the development of e-commerce, many countries have actively promoted electronic invoices (e-Invoice) to reduce obstacles and transaction costs arising from paper invoice operations on e-commerce. To follow the development trend, the Executive Yuan passed the “Knowledge Economy Development Plan” on August 30, 2000, listing electronic invoices as one of the development directions, which began the promotion of electronic invoices.

On November 29, 2000, the Ministry of Finance issued the “Directions for the trial operation of unified invoice for Internet transmission”, and on December 1, 2000, the application of business-to-business (B2B) electronic invoices began pilot operations. In 2004, the Ministry of Finance proposed the “Electronic Invoice Promotion Plan”, which planned to fully promote the application of electronic invoices within 5 years, and on November 11, 2014, it was approved by the Executive Yuan and recommended to give priority to the promotion plan, including it under the “Digital Taiwan Project” of the “Challenge 2008: National Development Key Plan”.

On August 16, 2005, the Ministry of Finance promulgated the “Regulations on Issuing a Uniform Invoice for Online Shopping and Delivering to Non-Business Persons”. Online shopping operators are exempted from issuing paper unified invoices to consumers, so as to promote the development of business-to-consumer (B2C) e-commerce.

On August 15, 2006, the “Electronic Invoice Integration Service Platform Construction and Maintenance Outsourcing Service Case” was launched to establish a safe and reliable basic environment for promoting the application of electronic invoices. The electronic invoice integration service platform of the Ministry of Finance was launched on December 6, 2006, providing business-to-consumer (B2C) electronic invoice application functions and business-to-business (B2B) electronic invoice processing functions, and then supporting the integration and interface between value-added service centers.

On November 30, 2006, the Ministry of Finance issued the “Directions for the Implementation of Electronic Uniform Invoices Operations”, and it became effective on December 6, 2006. The “Directions for the Implementation of Electronic Uniform Invoices Operations” was consolidated and merged with the “Key Points for the Pilot Operation of Uniform Invoice Transmission over the Internet” and “Operation Regulations for Issuing Uniform Invoices for Online Shopping and Delivery to Non-Business Persons” to adjust and relax the eligibility restrictions for business operators to use electronic invoices. The scope of application of the “E-Invoice Platform of the Ministry of Finance” was standardized as a legal basis for expanding the promotion of electronic invoices.

In view of the strong demand for business-to-consumer (B2C) electronic invoices among non-physical store operators, the “Directions for the Implementation of Electronic Uniform Invoices Operations” was revised and released on October 31, 2007. The main content is to incorporate TV shopping and catalog shopping into business-to-consumer (B2C) into the scope of application of electronic invoices, and lower the deposit required by business operators to use business-to-consumer (B2C) electronic invoices and the new requirements for total deposits paid by the head office.

In January 2008, the Ministry of Finance promoted the application of business-to-government (B2G) electronic invoices, and the National Taxation Bureau of Taipei of the Ministry of Finance, the National Taxation Bureau of Northern Area of the Ministry of Finance, and the Finance and Taxation Data Center participated in the trial operation, and gradually guided manufacturers to the integrated service platform in issuing electronic invoices to government agencies to complete the collection process.

On August 4, 2008, the Ministry of Finance issued a revised “Directions for the Implementation of Electronic Uniform Invoices Operations”, which came into effect on October 1, 2008. The amendments mainly increase the application and use regulations for the special characters for electronic invoices, and regulate that buyers, sellers, or independent third parties (value-added service centers) should complete the interface with the integrated service platform from January 1, 2009, and upload electronic invoices regularly. In addition, for business-to-consumer (B2C) electronic invoice donations, the relevant operating regulations for notifying recipients of the invoice details and sending notifications of winning prizes to recipients have been added.

On September 17, 2009, the Ministry of Finance once again revised and issued the “Directions for the Implementation of Electronic Uniform Invoices Operations”, which came into effect on October 15, 2009. The main content is to expand the application scope of business-to-consumer (B2C) electronic invoices to business operators who can accurately grasp the contact information of consumers, reduce the deposit for the use of business-to-consumer (B2C) electronic invoices to NT$1 million, and simplify prerequisite operations and other regulations for business operators to receive electronic invoices from the E-Invoice Platform.

At the end of 2009, to continue the current achievements in promoting electronic invoices, support the rapidly growing requirements for electronic invoice applications, and expand the scope influence of electronic invoice applications, the Financial Data Center, MOF, made a “Comprehensive Promotion of Electronic Invoice Application Plan” that would be implemented from 2010 to 2013. The plan was approved by the Executive Yuan on April 1, 2010, and was incorporated into the Executive Yuan’s “cloud computing industry development plan.”

Starting from July 2010, the 4-stage “Directions for the trial operation for the issuance of electronic invoices by physical consumption channels” was launched. In the first 3 stages, supermarkets, supermarkets, mass merchandisers, department stores, cosmeceuticals, and fast food industries were invited to try out the pilot operations. It can fully reflect the operating characteristics of different industries. In October 2010, the relevant regulations on “Directions for the Implementation of Electronic Uniform Invoices Operations” were revised again, and the requirement of a guarantee of NT$1 million for the use of electronic invoices for business-to-consumer (B2C) was cancelled. The use of electronic invoice between businesses (B2B) was automatically authorized, and conditions for applying for value-added service centers were relaxed. Furthermore, it was stipulated that from September 1, 2011, electronic invoices must be exchanged on the integrated service platform.

On November 8, 2010, the “Directions for the trial operation for the issuance of electronic invoices by physical consumption channels” was released to further promote the trial operation of issuing electronic invoices for physical consumption channels. In March, the fourth stage of trial operation was expanded and opened. On June 27, 2012, the original pilot points were amended and renamed as “Key Points of Pilot Operations for Issuing Electronic Invoices by Consumption Channels”, which came into effect on July 1 of the same year.

From 2011 to 2013, “The Second Generation of Electronic Invoice Promotion Counseling and Supervision and Inspection Outsourcing Service Case” and “Second Generation Electronic Invoice Integration Service Platform Construction and Maintenance Outsourcing Service Case” were launched to continue the improvement of related e-invoice application promotion guidance and platform, and improve the application environment of electronic invoices and the application scope of electronic invoices from the aspects of regulations, operations, systems, and promotion. On October 1, 2011, the first stage of the second-generation integrated service platform was built and launched.

On April 23, 2013, according to the resolution of the 2nd meeting of the “Government Service Process Reform Promotion Group” of the Executive Yuan on April 2 of that year: “Please request the Ministry of Finance to plan new measures for the convenience of electronic invoices and form a working circle”, and invited relevant units to hold a meeting. The preparatory meeting of the working circle was held on April 26 jointly by the Director of the Taxation Administration of the Ministry of Finance, the Directors of the five national taxation bureaus and the Director of the Fiscal Information Agency (FIA) of the Ministry of Finance to discuss and confirm the 1st meeting of the “Electronic Invoice Promotion Team” in 2013.

On June 28, 2013, the “Uniform Invoice Awarding Regulations” was revised, and exclusive awards for intangible electronic invoices were added to increase the incentives for consumers to obtain electronic invoices via carriers, and to implement energy saving and carbon reduction.

On August 22, 2013, the “Directions for the Implementation of Electronic Uniform Invoices Operations” was revised and issued, which came into effect on January 1, 2014. In order to expand the use of electronic invoices, promote the issuance of electronic invoices for physical consumption channels, and cooperate with the integration of virtual and real operations, the “Consumption Channel Issuing Electronic Invoice Trial Operation Points” was integrated and incorporated, and those who regulate the use of electronic invoices in transactions between business persons and non-business persons should introduce the use of carriers, and clearly stipulate the relevant rules for electronic invoice request, inquiry, donation, and redemption.

On November 5, 2013, the “Key Points for the Trial Operation of Issuing Electronic Invoices at Consumption Channels” and “The Key Points for Investment Promotion of the Trial Operations for Issuing Electronic Invoices at Consumption Channels” were abolished, and became effective on January 1, 2013, and electronic invoices were officially and comprehensively launched.

On December 31, 2013, the “Measures for the Use of Uniform Invoices” was revised, and the sixth type of unified invoices was added as an electronic invoice, and the definition, file type, and use of the electronic invoice certification page were added to meet practical needs. In addition, the time limit, obligation and method for the delivery and acquisition of electronic invoices were amended.

In 2014, in cooperation with the food safety policy of the Executive Yuan, the “Analysis, Application and Promotion Counseling Program of Huge Data of Finance and Taxation in the Food Industry” incorporated electronic invoices into the traceability and tracking process of Pan Food Cloud to assist in the traceability and tracking of food transaction flow. In addition, according to the phased announcement of the food industry’s use of electronic invoices, the MOF provided guidance to assist the food industry to adopt electronic invoices.

In 2014, according to the “Flagship 3: Active Full-Service Plan” item of the “Fourth Stage E-government Plan” of the National Development Council of the Executive Yuan, the “Promotion of Electronic Invoices, starting a Smarter Life Plan” was launched to integrate the strategic direction of cross-agency coordination, as well as strengthen the integration of e-commerce, cloud, intelligent logistics, and other industry plans. The aim is to build a borderless environment in terms of regulations, operations, system, and education, in order to achieve the ultimate goal of a comprehensive electronic government and a smart and better life by 2014 to 2016.

On September 3, 2015, the Executive Yuan approved the continuation of the “Food Industry’s Financial and Tax Huge Data Analysis Application and Promotion Counseling Program” to support food safety goals. The Enhanced Product Transaction Tracing & Tracking and Interdisciplinary Auditing Integration Program, which is scheduled from 2016 to 2019, expands the scope from food traceability and tracking of various commodities, to the value-added and cross-domain application using electronic invoice data across various ministries (organizations), providing ministries with integrated audit applications or industrial decision-making reference. On the same day, the Ministry of Finance approved the “Implementation Plan for Promoting the Introduction of Electronic Invoices to Public Utilities by National Taxation Bureaus of the Ministry of Finance”. With the active guidance of the Taxation Administration of the Ministry of Finance, the five National Taxation Bureaus, and the Fiscal Information Agency of the Ministry of Finance, public utilities started to issue electronic invoices in January 2016.

In order to further expand the use of electronic invoices and strengthen management, the “Directions for the Implementation of Electronic Uniform Invoices Operations” was amended on November 27, 2015 and came into effect on March 1, 2016. It stipulates that the “Electronic Invoice Sales Return, Purchase Withdrawal or Discount Certificate” and the value-added service center should be integrated with the service to regulate the exchange of information.

On December 30, 2015, Articles 32 and 32-1 of the “Value-added and Non-Value-Added Business Tax Law” were amended and promulgated, specifying that the business operator may issue, transmit, or receive unified invoices over the Internet or through other electronic means; operators shall transmit the unified invoice information and the identification information of the carrier approved by the Ministry of Finance used by the buyer to obtain the electronic invoice to the integrated service platform for reference. Furthermore, the amendment clearly specifies the definition of a carrier, allowing credit cards, electronic payment accounts, and other electronic payment instruments to act as carriers for electronic invoices. In addition, in order to accelerate the promotion of credit card as a carrier, the MOF worked with Taiwan’s financial intermediaries to facilitate domestic card-issuing banks to carry out card number identity confirmation and winning notification services, starting from the end of April 2016. As of the end of November 2025, a total of 26 card-issuing banks (including Taishin International Bank, E.SUN Commercial Bank, CTBC Bank, Bank of Taiwan, Land Bank of Taiwan, Hua Nan Commercial Bank, Bank of Kaohsiung, Mega International Commercial Bank, The Shanghai Commercial & Savings Bank, Union Bank of Taiwan, Taiwan Business Bank, Chang Hua Commercial Bank, Taipei Fubon Commercial Bank, COTA Commercial Bank, First Commercial Bank, Taichung Commercial Bank, Cathay United Bank, Far Eastern International Bank, Shin Kong Commercial Bank, Huatai Bank, Sunny Bank, Bank SinoPac, Yuanta Bank, Chunghwa Post, Next Bank, etc.) participated in the credit card carrier operation.

On January 1, 2017, the upper limit of the number of sets for the NT$1 million prize and the NT$1,000 prize exclusive to non-physical electronic invoices was increased, and the regulations that the winners of non-physical electronic invoices could designate a credit card, debit card, or electronic payment account to transfer the winning prize, etc., were added. This increased the incentives for the public to obtain intangible electronic invoices through carriers, and encouraged business operators to issue electronic invoices through carriers through consumer demand.

In line with the revision and announcement of value-added and non-value-added business tax law additions on December 30, 2015 and in response to practical operational needs, and to strengthen the management mechanism, the revision and release of “Directions for the Implementation of Electronic Uniform Invoices Operations” on January 12, 2017 added the stipulation that local tax collection agency in charge may require value-added service centers to make improvements within a time limit, and regulate that business operators should have barcode scanning machines or equipment for reading common carriers (except for those operating non-physical stores).

In 2017, according to the “Plan 3: Intelligent Industrial Operation” item of the National Development Council of the Executive Yuan’s “The Fifth Phase of Electronic Government Plan-Digital Government”, to provide multiple communication channels, broadly accept the opinions of the public, and adapt to future information and communication development trends, it is necessary to strengthen the content of electronic invoice API and promote mobile application services. Using the cross-agency exchange platform provided by the National Development Council to simplify the service process and develop cross-domain data applications, it is expected that the goal of an integrated service platform can be achieved in 2017-2020. And with the four major aspects of basic optimization, cross-domain innovation, information governance, and digital services as the yearly goals, the MOF will make good use of information and communication technology and promote public-private collaboration to achieve a seamless cross-domain vision to create a better life.

In 2018, the Taxation Administration of the Ministry of Finance, the Fiscal Information Agency of the Ministry of Finance, and the five National Taxation Bureaus held a naming event on the Facebook fan page, and voted “Cloud Invoice” as the marketing promotion word, and combined the logo of the Ministry of Finance and the unique image concept to design its cloud invoice logo. “The Ministry of Finance Cloud Invoice Mark Map” was published in the Trademark Gazette of the Intellectual Property Office of the Ministry of Economic Affairs in August 2018 for future reference, and obtained the trademark right through examination on January 9, 2019. It has been used in various publicity activities, promotional literature, websites, and FB community page to deepen the public’s impression and promote cloud invoices. In order to implement the policy of energy saving and carbon reduction, encourage the public to develop the habit of storing cloud invoices in carriers, and increase the winning rate of cloud invoices, special awards for cloud invoices have been added. The total prize for each period from May to December 2025 is as high as NT$1.717 billion. The drawing includes 30 sets of NT$1 million prizes, 16,000 sets of NT$2,000 prizes, 100,000 sets of NT$800 prizes, and 3.15 million sets of NT$500 prizes. The MOF has strengthened the marketing of exclusive cloud invoice awards through various publicity channels. In addition, in line with the promotional theme of “Cloud Invoice Four Steps”, the public is encouraged to actively download the unified invoice redemption APP of the Ministry of Finance, so as to facilitate the request, storage, management, and donation of cloud invoices. In November 2019, the integrated service platform member carrier home portal function was completed, which greatly improved the convenience when consolidating other member carriers. As of the end of November 2025, 460 member carriers and 17,891 business operators have participated in this operation.

In 2018, in order to make the public understand that with the carrier approved by the Ministry of Finance to store electronic invoices, they can use the cloud service function to query and receive relevant invoice information at any time. The “Uniform Invoice Award Regulations” and “Regulations Governing the Use of Uniform Invoices” are amended, changing the term “non-physical electronic invoice” to “cloud invoice” to clarify the definition of cloud invoice to facilitate promotion.

In conjunction with the Regulations Governing the Use of Uniform Invoices revised on January 19 and July 16, 2018, as well as the amendment of the Uniform Invoice Award Regulations on June 13 to optimize the operations of value-added service centers, the Directions for the Implementation of Electronic Uniform Invoices Operations were amended on July 18, 2018, and took effect upon promulgation. On October 25, 2018, in conjunction with the implementation of unified invoice multi-reward service operations starting from January 1, 2019, a service was launched allowing the public to redeem the prizes for winning electronic invoices through a MOF APP on their mobile device. The Uniform Invoice Award Regulations was revised and came into effect on January 1, 2019.

On November 22, 2018, in order to meet the operational needs of multi-reward redemption services, the “Directions for the Implementation of Electronic Uniform Invoices Operations” was revised, and took effect on January 1, 2019.

To be in line with the revision of the tax and tax collection agency’s management of accounting books and vouchers for profit-making enterprises, and to simplify the operations of overseas e-commerce operators and respond to the actual needs of tax collection, the “Directions for the Implementation of Electronic Uniform Invoices Operations” was amended on January 9, 2019 and came into force on January 1, 2019. Overseas e-commerce companies use the “cross-border e-commerce e-mail carrier” (consumer’s e-mail) to issue cloud invoices, which went live on January 1, 2019. As of the end of November 2025, a total of 166 overseas e-commerce companies have imported cloud invoices.

In order to increase the convenience of cloud invoice redemption for the public, on July 23, 2020, Points 4 and 5 of the “Operation Guidelines for Diversified Services of Uniform Invoice Redemption” were amended and published, clearly stipulating the redemption method of winners of cloud invoice prizes through member carriers. If the winner has already consolidated their carriers prior to the prize drawing, they may log in to the uniform invoice redemption APP of the MOF through mobile phone barcode to redeem their prize or print out their winning invoice at a convenience store KIOSK and redeem their prize in person at a physical location.

The “Directions for the Implementation of Electronic Uniform Invoices Operations” were revised and came into force on June 4, 2021 to reflect the simplification measures for bonded area business operators to sign zero tax rate certificate, adjust the financial conditions of value-added service centers, and respond to the practical needs of auditing. On November 5, 2021, in order to promote the bilingualization policy, the full text of the Directions for the Implementation of Electronic Uniform Invoices Operations (including attachments) was translated into English, and published on the Ministry of Finance’s regulations inquiry system for public reference.

On July 5, 2023, the “Directions for the Implementation of Electronic Uniform Invoices Operations” were revised and released. This aimed to manage the allocation mechanism of electronic invoice serial numbers effectively and accommodate the impact of the COVID-19 pandemic by temporarily postponing the review of financial conditions and operational requirements for value-added service centers.

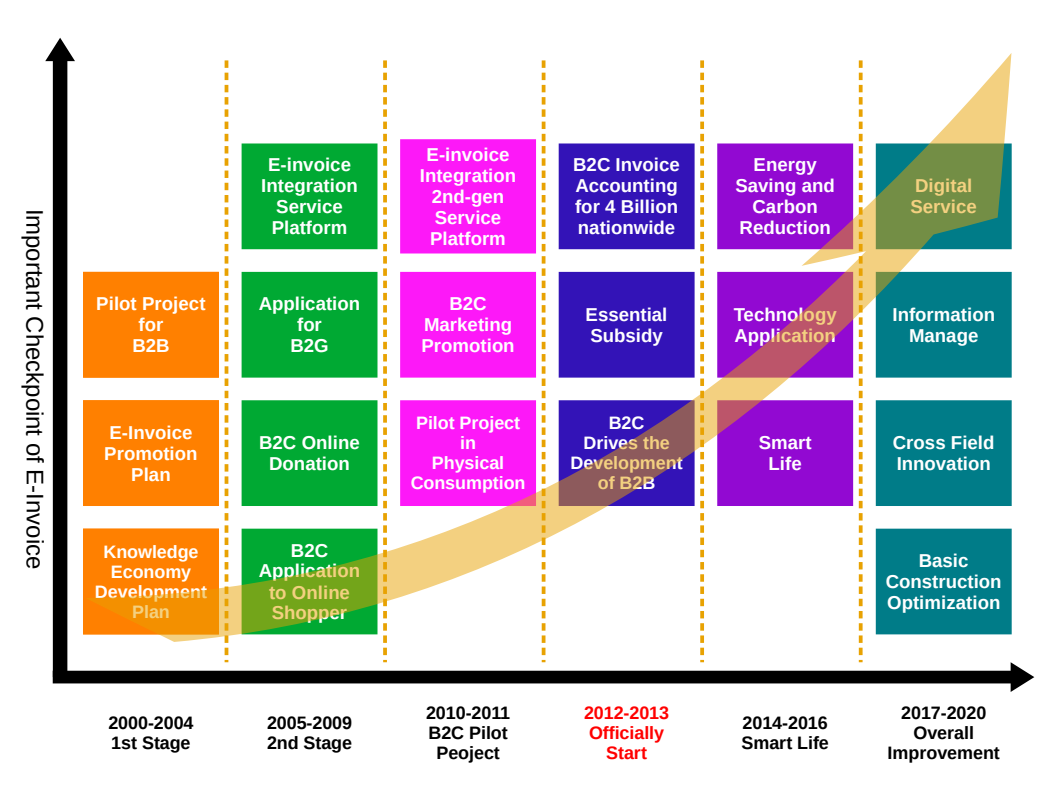

As of 2020, the promotion of e-invoice has been completed in phases. Most of the operations have been standardized and continue to be implemented. The ratio of cloud invoices has been increasing year by year. The important measures in each stage from 2000 to 2020 are as follows:

Award-winning records of E-invoice

| 2011 |

The e-Invoice Project was awarded with “The FutureGov 2011 Reward – Public Sector Organization of the Year-North Asia Award” by the FutureGov. |

| 2011 |

The e-Invoice Project was awarded with “The 3rd place in the ‘e-Commerce Government’ category of 2011 eASIA Award”. |

| 2012 |

The e-Invoice Project was honored with “The Annual project management award” by the Project Management Institute (PMI). |

| 2012 |

The e-Invoice Project was honored with “The 2012 International Project Management Benchmark Gold Award and the Best Practice Competition Award” by the Project Management Institute (PMI) Taiwan Chapter. |

| 2013 |

The e-Invoice Project was honored with “The 7th Natural Person Certificate Application System Excellent Award” by the Ministry of the Interior. |

| 2013 |

The e-Invoice Project was honored with the “Standardization and Contribution Award” by the Ministry of Economic Affairs. |

| 2013 |

The e-Invoice Project was honored with the “Cloud Innovation Service Award and Open Data Award” by the Cloud Computing & IoT Association in Taiwan. |

| 2013 |

The thirty seconds television commercial of electronic invoices won the Silver Winners of Cannes Corporate Media & TV Awards. |

| 2013 |

The e-Invoice Project was honored with the “Top 100 Innovation Award” in 2013 by IT-Month. |

| April 2014 |

The e-Invoice Project was awarded with “The RFID Green Award” by the Radio Frequency Identification (RFID) Journal, an international journal. |

| June 2014 |

The e-Invoice Project was awarded “The Specialty of the 6th Government Service Quality Service Award.” |

| January 2015 |

Promotion of e-Invoice and service of the pre-calculation of Individual Income Tax was awarded “The 2nd Smart City Innovation Application Award” by the Taipei Computer Association. |

| May 2016 |

Won the Second Presidential Innovation Award Group. |

| May 2017 |

Digital Transformation Association (DTA) awarded the “2017 DTA Award for Digital Service Innovation – Open Digital Government” (1st place). |

| September 2017 |

The Asia Pacific Council for Trade Facilitation & Electronic Business (AFACT) awarded the gold award in the Open Digital Government category to the FIA for its project, “Innovative E-invoice Service Applications of the Ministry of Finance”. |

| November 2018 |

Won the “2018 Cloud IoT Innovation Award-Government Service Group” Outstanding Application Award from Cloud Computing & IoT Association in Taiwan. |

| November 2019 |

The E-Invoice Division participated in the 2019 National Data Open Application Award with the theme of “Consumer Channel Invoice Application Service” and won third place. |

| November 2024 |

The E-Invoice Innovative Service has been honored with the ESG Award under the ASOCIO 2024 DX Award. |

| November 2024 | The E-Invoice Platform has been honored with the 2024 Cloud IoT Innovation Award for Outstanding Application. |

| November 2025 |

The E-Invoice Project was awarded "The 8th Government Service Award." |